When the crypto market slips below $3 trillion, people notice. And this week, it’s happened again.

On Wednesday, total crypto market capitalization dipped under that key psychological level for the third time this month, reigniting fears that this isn’t just a quick pullback, it could be the start of a deeper correction.

What’s interesting is where the selling pressure is coming from. This time, it’s not panic from retail traders. It’s the big names.

Big Money Is Pulling Back, Not Chasing

The losses are concentrated in large-cap tokens with heavy exposure to institutions and ETFs. That’s a clue.

Bitcoin (BTC) slipped about 1.5% to $86,600, giving back gains from earlier in the week. That move stalled momentum across the market. Ether (ETH) drifted back toward $2,930, while XRP failed to hold above $1.90.

These are the same assets that benefited the most from institutional inflows earlier this year. Now, they’re leading the decline.

As Alex Kuptsikevich, chief market analyst at FxPro, put it, “Major coins are increasingly becoming victims of changing institutional sentiment.” In other words, professionals are trimming exposure, not adding risk.

Crypto Slips While Asian Stocks Climb

Crypto will crash hardest pic.twitter.com/9bvXaPvkn9

— Esther Lydia Tan (@lydia6061) December 17, 2025

What makes this move more telling is the contrast.

While crypto struggled, Asian equity markets posted modest gains. The Hang Seng, Shanghai Composite, Kospi, and Indonesia’s IDX all moved higher, supported by expectations of fresh stimulus from China after weak November economic data.

That divergence highlights something important. Crypto isn’t trading on regional growth stories right now. It’s reacting to global liquidity and dollar strength.

A Stronger Dollar Adds More Pressure

The U.S. dollar index (DXY) bounced back to around 98.30, recovering from a 2.5-month low. The move followed U.S. labor data showing 64,000 jobs added in November, beating expectations, even as unemployment climbed to 4.6%, its highest level since 2021.

A firmer dollar typically weighs on dollar-denominated assets like Bitcoin. And that’s exactly what we’re seeing. Gold has held up better, staying above $4,300 per ounce, but crypto hasn’t been as resilient.

Fear Is Back in the Market

Sentiment has taken a hit.

The Crypto Fear & Greed Index dropped to 11, firmly in extreme fear territory and its lowest level in a month.

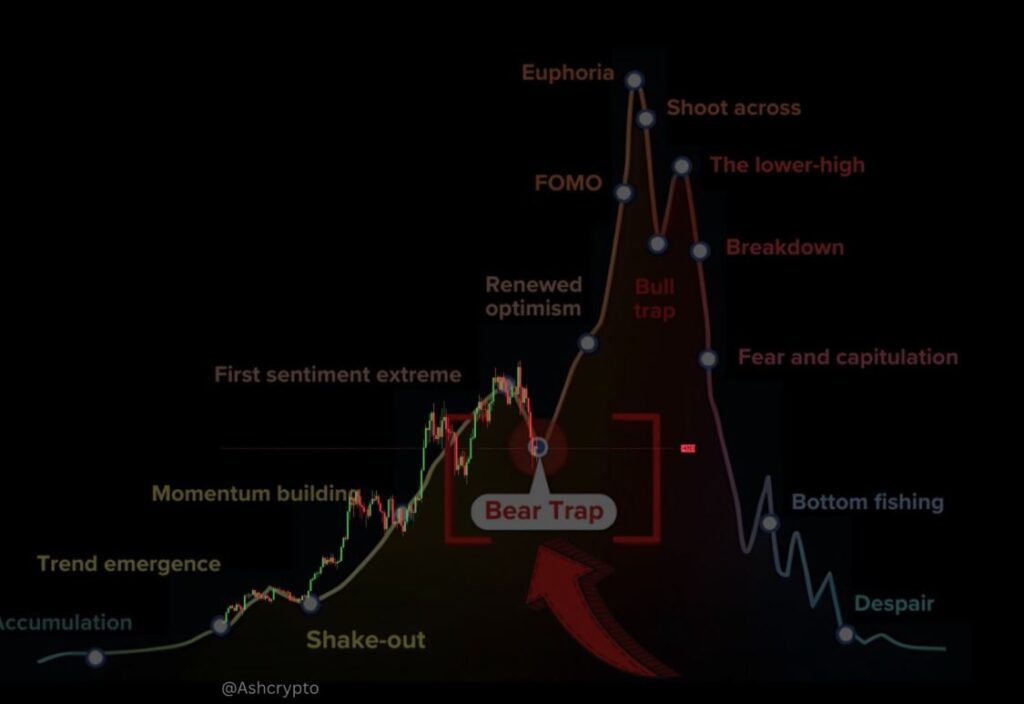

This pullback also looks different from earlier dips in 2025. Multiple large-cap assets have broken intermediate support levels, suggesting this move may have more depth than a routine shakeout.

From a technical perspective, traders are watching $81,000 as the next major support for Bitcoin. That level lines up with November lows and prior consolidation zones. If it fails, the market could revisit the $60,000 to $70,000 range, a historically important area from previous cycles.

Thin Liquidity Is Making Moves More Violent

Liquidity is making everything worse.

Data from FlowDesk shows declining market depth and lower leverage, which is typical as traders de-risk toward year-end. With fewer buyers and sellers on the books, even modest orders are moving prices more than usual.

That’s why we’re seeing sharper intraday swings, especially during U.S. trading hours, despite overall volumes remaining well below yearly averages.

On-Chain Data Tells a Mixed Story

On-chain signals aren’t screaming panic, but they aren’t all bullish either.

CryptoQuant suggests Bitcoin’s recent bounce may have run out of steam, increasing the odds of a deeper correction before the next meaningful rally.

At the same time, long-term accumulation hasn’t stopped. Glassnode data shows continued buying by corporations and financial institutions, not just miners. Strategy’s recent purchase of 10,624 BTC, worth nearly $1 billion, is a clear example of selective conviction beneath the surface.

Read More: Crypto In 2026

The Bottom Line

The crypto market is once again testing the $3 trillion floor, and this time the pressure is coming from the top. Large-cap assets are sliding as institutions reassess risk in a tighter liquidity environment and a strengthening dollar.

Long-term fundamentals and accumulation trends are still intact. But with thin liquidity and fragile sentiment, volatility is likely to remain elevated.

What happens next hinges on one question:

Does the $3 trillion level hold or does this pullback turn into a deeper year-end drawdown?

The answer will shape how crypto enters the new year.