I didn’t “get” crypto mining from a technical blog or a flashy chart. I got it when a friend slid his power bill across the table and laughed.

“This,” he said, “is the price of digital gold.”

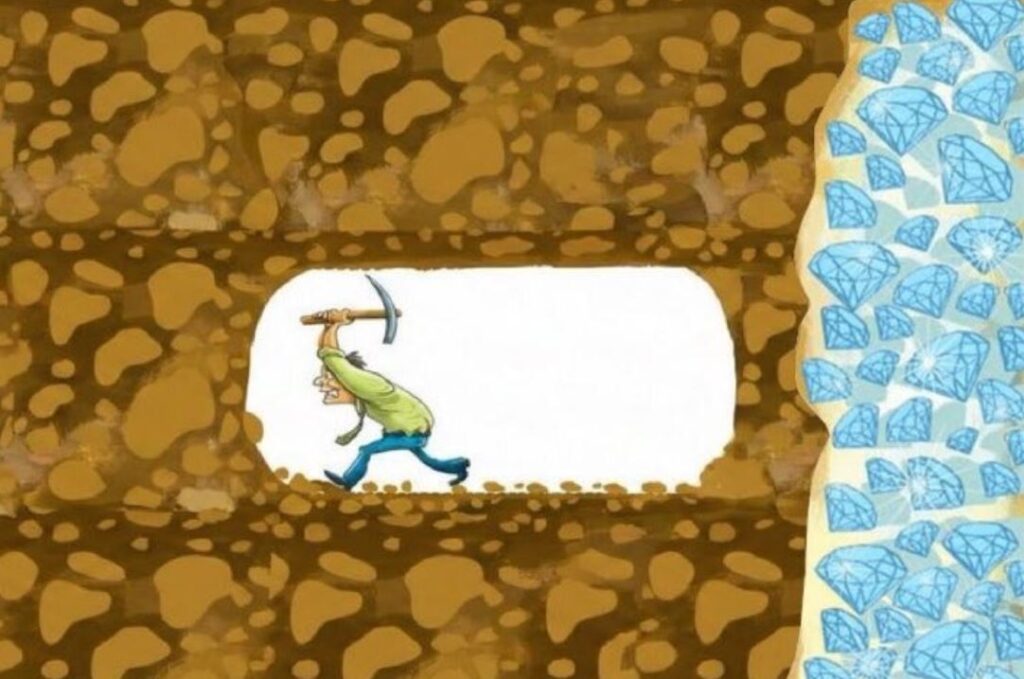

That one moment explains mining better than most whitepapers ever will. Because crypto mining is a gold rush. Just updated for the internet age. No pickaxes. No dirt. Just heat, noise, and machines running nonstop.

Let’s break it down, plain and simple.

What is crypto mining, really?

Think about traditional gold mining.

You invest money. You burn resources. You dig. And you hope what you find is worth more than what you spent. Crypto mining works the same way. Just digitally.

Mining is how certain cryptocurrencies, Bitcoin being the biggest, verify transactions and create new coins. Instead of digging into the ground, miners use powerful computers to solve math problems.

Solve the problem first? You earn the right to add the next block of transactions to the blockchain. And you get paid for it.

That payment comes from two places:

- Transaction fees

- Newly created coins

Simple idea. Ruthless competition.

What’s actually happening behind the scenes?

Picture the blockchain like a shared Google Doc. Anyone can view it. No one owns it. But it needs constant updates. Each update is a block.

Here’s how mining creates one:

- Transactions pile up

People send Bitcoin. Each transaction includes a small fee. These wait in line. - Miners bundle transactions

Miners grab a batch of pending transactions. Higher fees usually get picked first. Not emotional. Just economics. - The guessing game begins

Miners race to solve a cryptographic puzzle. It’s not clever. It’s brute force. Machines guess trillions of numbers per second, hunting for the right one—the nonce—that produces a valid hash. - One miner wins

The first correct answer gets broadcast to the network. - Everyone double-checks

Other miners verify the solution. If it’s valid, consensus is reached. - The block is added

Transactions are confirmed. New coins may be issued. The winning miner gets paid.

What kind of hardware does this actually require?

This isn’t a side hustle on your laptop anymore.

Modern mining mostly uses ASICs: specialized machines designed for one job only: hashing. GPUs still exist on smaller networks, but Bitcoin mining? That’s an ASIC-only arena now.

Performance is measured in hash rate. More hashes per second = better odds of winning. But there’s a catch.

More power also means:

- More electricity

- More heat

- Higher costs

That’s the trade-off every miner lives with.

Why does mining even exist?

Because proof-of-work blockchains need it to survive.

Mining does three critical things:

1. It secures the network

No central authority. No single server. Thousands of independent machines verify each other. That’s why Bitcoin is so hard to attack.

2. It enforces fairness

You can’t fake work. You earn rewards by proving you spent real resources.

3. It distributes new coins automatically

No approvals. No gatekeepers. Do the work, get paid.

In places with cheap electricity, mining has even become a full-blown industry. Jobs. Infrastructure. Entire local economies. But let’s not pretend it’s all upside.

The uncomfortable truths about mining

This is where reality kicks in.

Energy use is massive

Some networks consume electricity on the scale of small countries. That’s not clickbait. It’s math.

Hardware is expensive and disposable

Top machines cost thousands, and become obsolete fast. Today’s powerhouse is tomorrow’s e-waste.

Environmental impact is real

Carbon emissions. Power plants. Electronic waste. This criticism isn’t made up.

It’s technically demanding

Mining isn’t plug-and-play. You need cooling, maintenance, security, and constant monitoring.

Profit margins are shrinking

More miners join. Rewards get cut. Difficulty increases. What worked last year may fail today.

Taxes complicate everything

Mining rewards are taxable in many regions. Tracking and reporting them properly is a headache.

Risk is everywhere

Machines fail. Prices crash. Power costs jump. Hackers target mining operations constantly.

This is not passive income.

It’s an industrial business with real stress.

So… is crypto mining worth it?

There’s no universal answer. If you’re chasing profit, the math has to work:

- Cheap electricity

- Efficient hardware

- Favorable market prices

Miss one of those, and the whole model breaks.

If sustainability matters to you, proof-of-work may feel like a dead end. That’s why many projects and investors are moving toward proof-of-stake systems, which use far less energy and don’t require mining at all.

That shift isn’t random. It’s evolution. Crypto mining helped build this industry. But it’s also pushing it to grow up. The smart move now isn’t blind optimism or blind criticism.

It’s understanding the costs. Understanding the impact. And deciding whether chasing digital gold still makes sense for your values and your wallet.