If you’re borrowing against crypto, the interest rate isn’t just a number. It’s a strategy.

In crypto lending, how APR is structured can matter as much as loan-to-value ratios and liquidation thresholds. And most platforms give borrowers one big choice up front: fixed or variable APR.

What APR Really Means in Crypto

APR in crypto isn’t like a bank loan. Rates don’t depend on your credit score. They move based on:

- Collateral volatility

- Platform liquidity

- Real-time risk metrics, especially LTV

That’s why two borrowers on the same platform can pay very different rates at the same time.

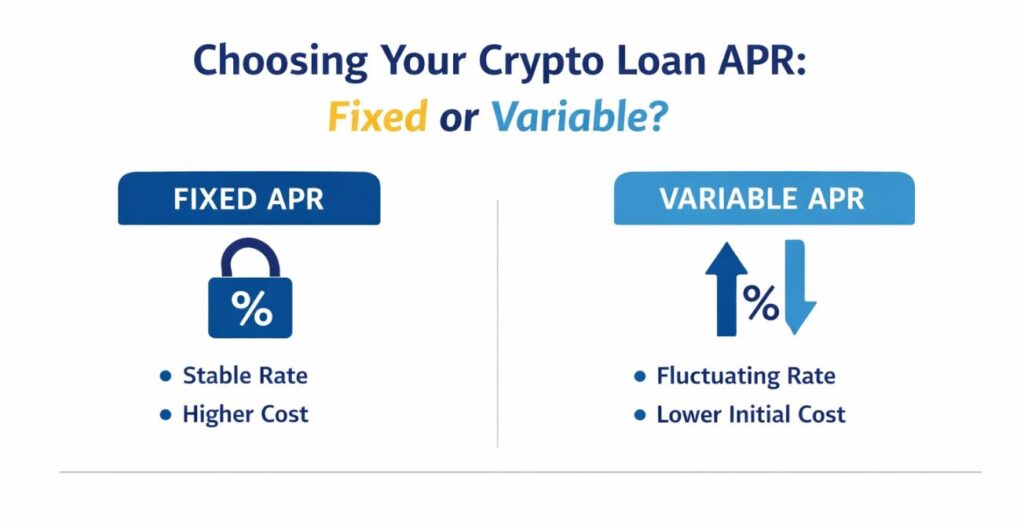

Fixed APR: Stability at a Price

Fixed APR loans lock in your rate for the full term, or for a set period. Once it’s live, it doesn’t change, even if the market does.

That predictability comes at a cost. Fixed rates are usually higher upfront, compensating lenders for interest-rate risk. Repayment schedules tend to be rigid, and mid-loan adjustments are often limited.

They’re simple. But they’re not always cheap.

Variable APR: Flexible but Demanding

Variable APRs move with the market. When liquidity is high and risk is low, rates can start out cheaper. When demand spikes or volatility hits, they can rise fast.

These loans reward active borrowers who monitor their positions. Ignore them, and costs can quietly climb.

When Does Interest Actually Start?

This is where many borrowers get tripped up.

On many platforms, interest accrues on the entire loan amount from day one, even if you haven’t used all the capital. Newer models are trying something different.

Some platforms now charge interest only on withdrawn funds, not the full credit line.

A Credit-Line Approach

Clapp, for example, uses a regulated credit-line model. Users lock crypto as collateral, receive a borrowing limit, and pay interest only on what they actually draw.

Unused credit carries 0% APR. Repayments immediately restore available credit. Rates are variable and tied directly to LTV, meaning risk and cost move together.

It’s a closer match to how capital is used in the real world.

Why Volatility Changes Everything

Crypto volatility amplifies the impact of interest structure.

Fixed APRs offer peace of mind during turbulent markets but can feel expensive when conditions improve. Variable APRs can save money, but only if borrowers actively manage risk.

There’s no universal winner. It depends on your time horizon, risk tolerance, and attention level.

What Borrowers Need to Watch

Industry analysts say transparency is the real differentiator. Borrowers need clear answers to three questions:

- When does interest start accruing?

- What causes rates to change?

- How does APR interact with LTV and liquidation risk?

The Bottom Line

Crypto lending is getting smarter. Interest models are shifting away from theoretical exposure and toward actual capital usage.

For borrowers, the takeaway is simple: APR isn’t just a cost. It’s a lever. Choose the wrong one, and it can work against you. Choose the right one, and it becomes part of your strategy.