This is the part of the year when markets stop taking risks and start counting wins.

And crypto is doing exactly that.

As the final full trading week of the year begins, prices are slipping. Not because something broke. But because investors are stepping back, trimming exposure, and locking in profits.

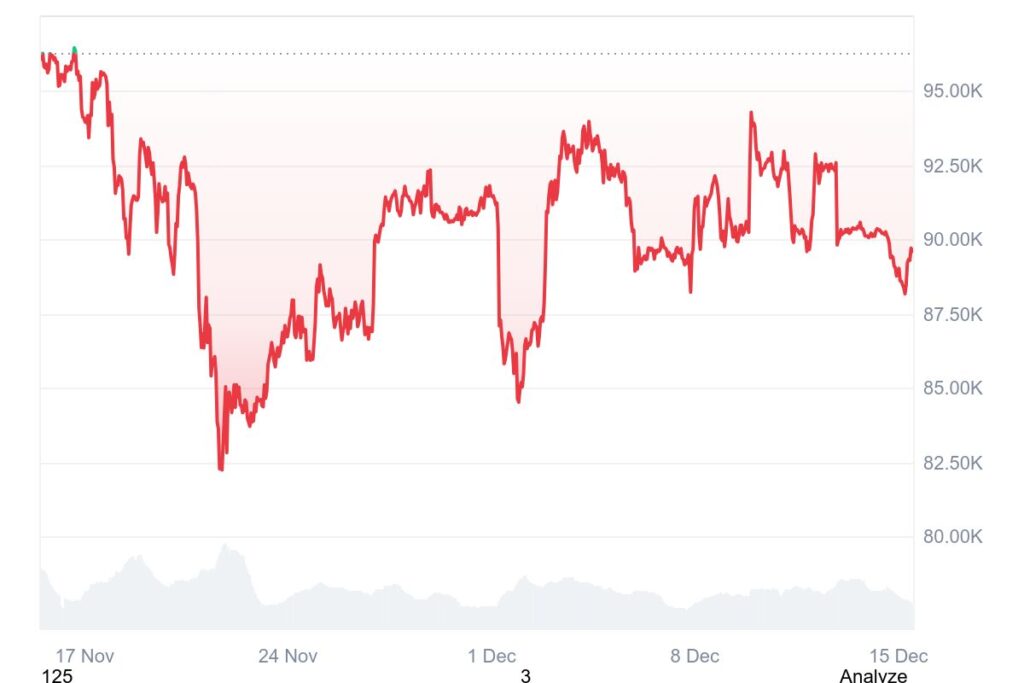

Bitcoin dipped about 0.5%, trading near $89,600 and sitting just above last week’s lows. Ether followed, easing to around $3,120. Most major tokens moved lower. XRP, Solana, and Dogecoin were down as much as 2%.

The theme is caution.

U.S. equity markets set the tone last week after a tech-led selloff. Concerns over heavy AI spending and whether earnings can justify current valuations triggered a pullback. Even though S&P 500 and Nasdaq 100 futures bounced about 0.2% during Asian hours, confidence didn’t fully return.

Investors are asking a hard question: do technology stocks still deserve these prices heading into 2026?

That uncertainty has spilled into crypto.

Digital assets haven’t found their footing since October’s drawdown. Momentum faded. Volumes thinned. And when liquidity dries up, price moves tend to look worse than they really are.

According to Jeff Mei, COO of BTSE, investors are hesitant for three reasons: October’s dip, fears of an overvalued U.S. stock market, and mixed signals from the Federal Reserve.

There are still positives under the surface.

Bitcoin ETF inflows remain net positive. The Fed has started buying back securities, adding liquidity to the system. Historically, that liquidity doesn’t stay parked forever. Some of it usually rotates back into risk assets, including crypto.

But timing matters.

As Mei points out, this is classic year-end positioning. Traders are taking profits now and waiting to reassess in early 2026 before putting fresh capital to work.

Thin liquidity is amplifying the moves.

Augustine Fan, head of insights at SignalPlus, says the current sell-off extends Friday’s negative bias. With volumes down sharply since the 10/10 event and sentiment turning broadly negative, Bitcoin and Ether are acting as proxies while traders adjust exposure across the rest of the market.

Fan also cautions against reading too much into short-term price action. In thin markets, daily or hourly moves can mislead. Still, he notes that sentiment remains weak and the path of least resistance points to softer prices into year-end.

The bigger picture hasn’t changed.

U.S.-listed Bitcoin ETFs continue to attract capital. Central bank liquidity remains supportive. Once volumes return and traders come back from the sidelines in early 2026, conditions could turn more constructive.

For now, the market is doing what it always does in late December.

It’s pausing. Locking in gains. And waiting for the calendar to flip.