In a market where most crypto assets are struggling, Solana (SOL) exchange-traded funds (ETFs) are making waves. For seven days straight, these ETFs have recorded continuous inflows, defying both SOL’s price dip and the broader crypto market trends.

Since the launch of REX-Osprey’s staked SOL ETF in July, this streak signals a growing appetite for Solana from institutional and traditional finance players—and it’s turning heads.

Institutional Interest is Heating Up

Even as SOL’s price has been on a downward slide and on-chain metrics like total value locked (TVL) lag, institutional investors are stepping in. One clear example is Bitwise’s BSOL mid-cap value ETF, designed to capture Solana’s performance. Bloomberg ETF analyst James Seyffart even called SOL the “rocket-like performer of 2025”.

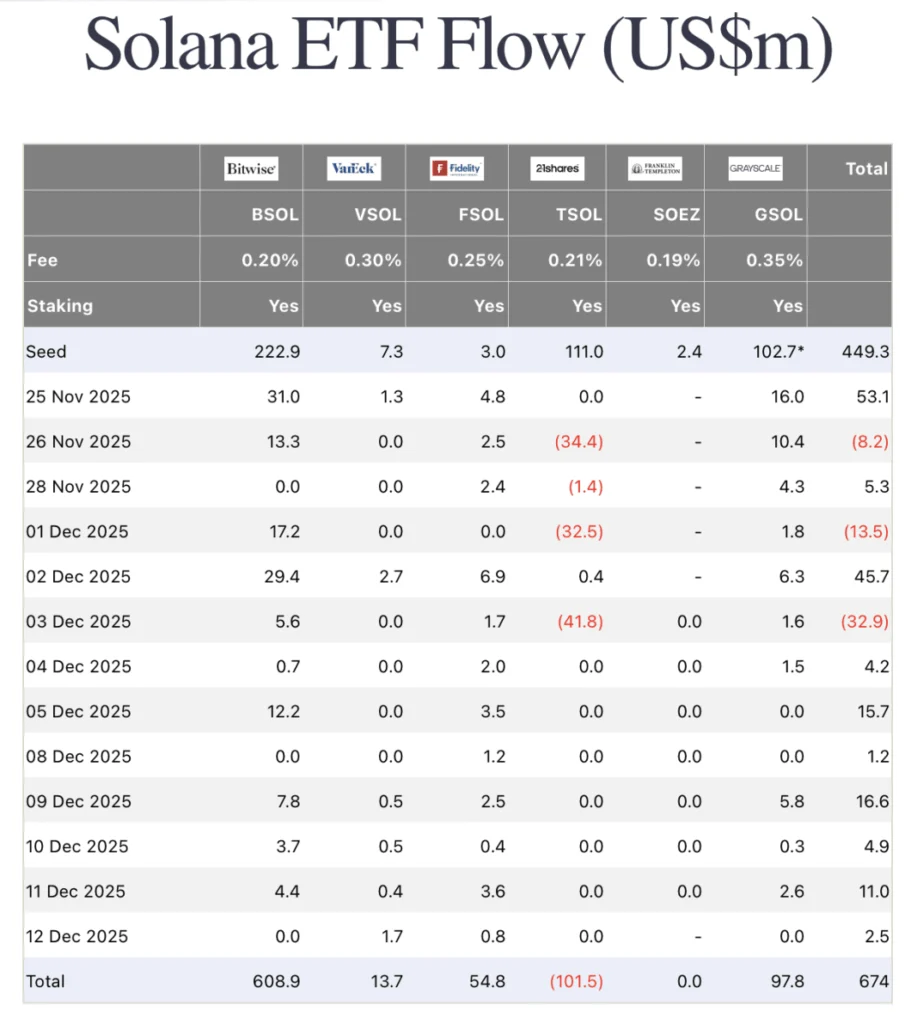

Numbers speak volumes: SOL-related ETFs have now amassed roughly $674 million in net inflows, according to Farside Investors. Meanwhile, SOL’s market cap has dipped over 2% in the last week, based on Nansen data.

Demand isn’t just in ETFs. SOL perpetual futures open interest has climbed to over $447 million, proving there’s still strong appetite for the token. Of course, SOL’s price has dropped almost 55% since its January peak of $295, partly due to the launch of the Trump memecoin on Solana’s network.

A Favorable Regulatory Backdrop

The regulatory environment is also looking brighter for Solana. With SOL ETFs now available in the U.S. and crypto executives and regulators showing interest in internet-based capital markets, the path for SOL integration is widening.

SEC Chair Paul Atkins put it plainly: “US financial markets are on the verge of going on-chain.” In other words, there’s room for digital assets like Solana to expand within the U.S. financial ecosystem.

Why This Matters

The seven-day inflow streak isn’t just a number—it’s a signal to the crypto world. Despite SOL’s declining price and underperforming on-chain metrics, institutional and traditional finance investors are warming up to the network.

Factors like the presence of SOL ETFs in the U.S. and a crypto-friendly regulatory climate are making Solana a standout for investors. While markets remain volatile, one thing is clear: SOL and other digital assets are capturing serious attention—and the next chapters could be game-changing.