Solana’s price dropped more than 3% in the past 24 hours, and the move is not happening in isolation. Technical weakness, combined with a broader shift toward risk-off behavior, is weighing heavily on high-beta assets across the crypto market.

The decline matters because SOL is now testing key support levels at a time when fear across digital assets is already running high.

Solana Fails a Key Technical Test

The latest slide began after Solana failed to hold above the 50% Fibonacci retracement level at $134.14, a rejection that quickly invited renewed selling pressure. Since then, SOL has slipped below $128 and is now trading under the 100-hour simple moving average, a signal that short-term momentum remains fragile.

The price recently touched a local low near $121 before attempting a modest bounce. Even so, upside remains limited. Resistance is building near $128 and $131, where a bearish trend line continues to cap any meaningful recovery.

Indicators Still Point Lower

Momentum indicators suggest the pressure has not eased yet. The RSI (7) sits at 27.57, placing Solana firmly in oversold territory, but oversold does not automatically mean a rebound. At the same time, the MACD histogram at −0.051 confirms that bearish momentum is still in control.

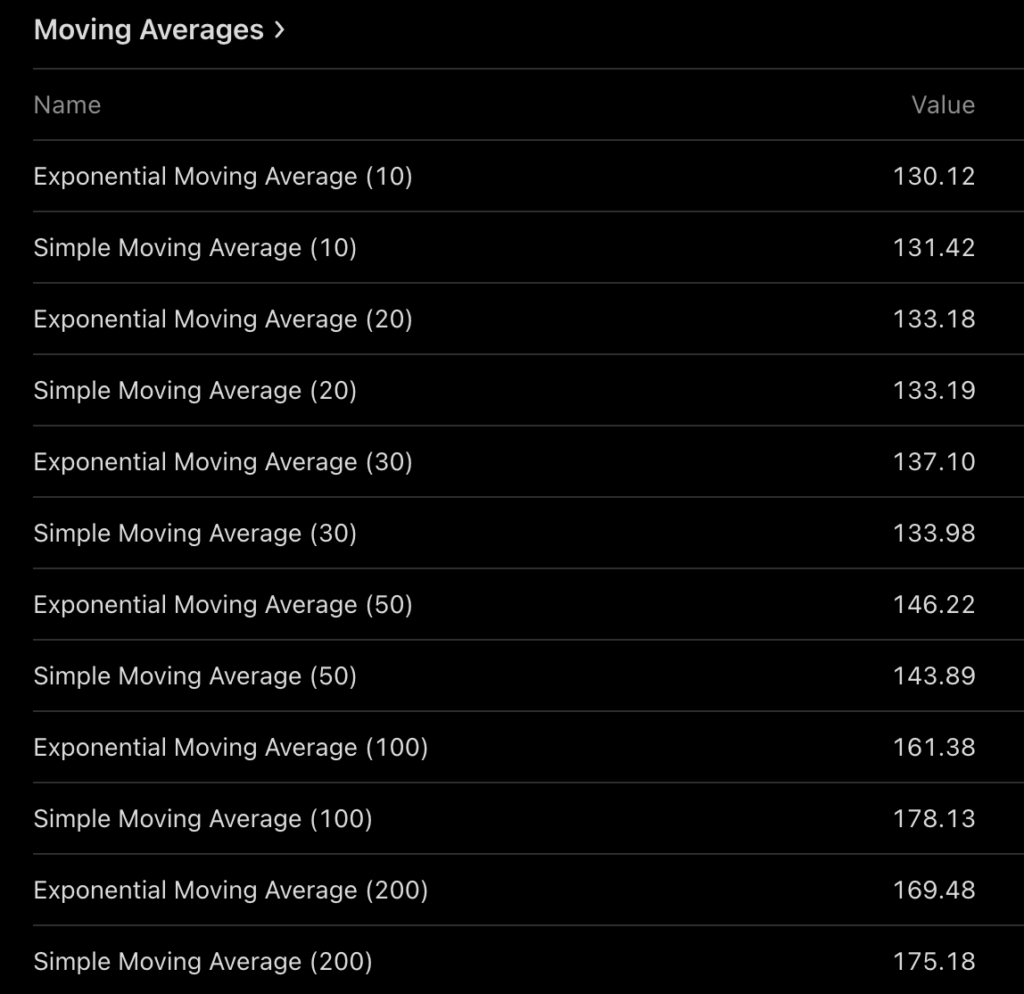

Trend indicators tell a similar story. The EMA-10 at $130.12, EMA-50 at $146.22, and EMA-200 at $169.48 all remain well above the current price, highlighting sustained selling pressure across both short- and long-term time frames. Without stronger confirmation, confidence in a quick reversal remains limited.

Risk-Off Sentiment Hits Altcoins Hardest

The broader crypto market lost roughly $51 billion in value over the past day, as investors pulled back from riskier positions. The Crypto Fear & Greed Index dropped to 22, signaling Extreme Fear, while Bitcoin dominance climbed to 59.25%, a classic sign of defensive positioning.

Institutional flows reinforced this shift. Bitcoin ETFs recorded $457 million in inflows, while Ethereum ETFs saw $22 million in outflows, a combination that tends to pressure correlated altcoins like Solana.

What Comes Next for SOL

Traders are now watching the $122 and $120 support zones closely. A decisive break below these levels could open the door to deeper pullbacks toward $112 or even $105.

On the upside, Solana would need to reclaim $130 and hold above near-term resistance to stabilize sentiment. Until broader market conditions improve, Solana news is likely to remain closely tied to Bitcoin’s direction and the market’s overall appetite for risk.