Here’s the simple truth: when a key price breaks, the market tells you a story. And right now, XRP is telling a cautious one.

Over the last 24 hours, XRP fell 4.15% and dropped below the critical $2 support level. This wasn’t just another small dip. That $2 zone had acted like a safety net for days. Once it snapped, selling picked up fast.

This move weakens the short-term XRP price outlook. Buyers tried to defend the level, but demand wasn’t strong enough to spark a rebound. When support fails without a fight, it usually means sellers have the upper hand.

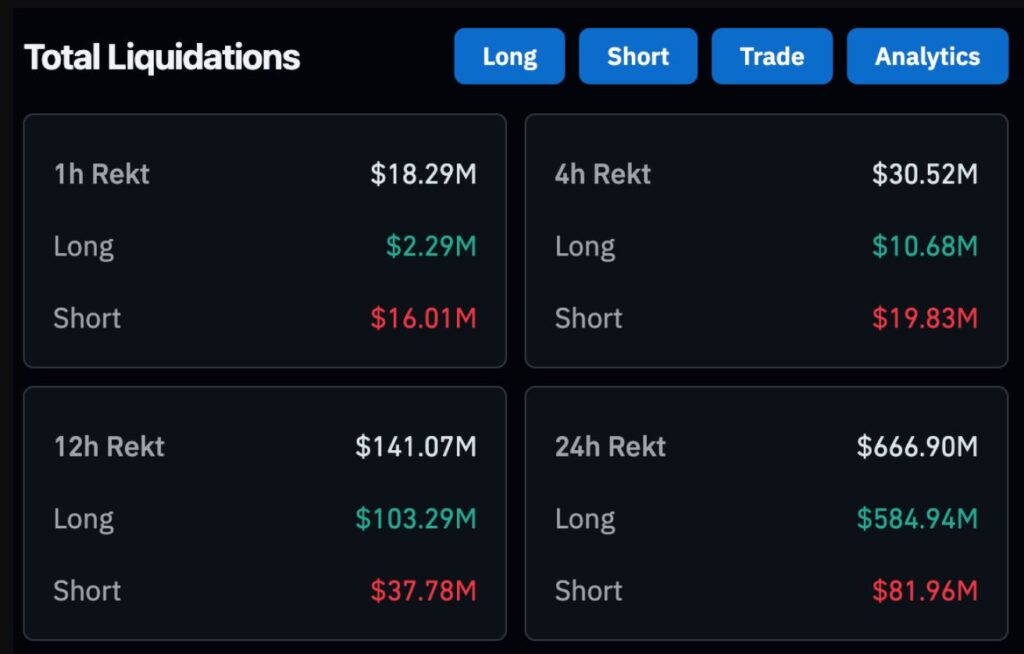

The liquidation data confirms it. Long liquidations jumped to $584 million. That’s a sign many traders were overexposed and caught off guard. Sharp liquidations often accelerate downside momentum, at least in the near term.

Volume adds another layer to the story. Trading activity has doubled in a single day, now sitting around $3.9 billion. Rising volume during a breakdown typically points to strong selling pressure, not quiet consolidation.

But here’s where it gets interesting.

Despite the price drop, XRP-related ETFs continue to attract money. These funds have recorded net inflows for 21 straight days. That suggests institutions and long-term investors are still building positions through regulated products, even as short-term traders panic.

XRP Price Prediction: Why $1.86 Is the Line to Watch

Looking at the 4-hour chart, the breakdown is clear. XRP fell below $2 with heavy volume, then slid quickly toward the next support at $1.86.

That level now matters more than anything.

If XRP holds $1.86, we could see a short-term bounce. If it breaks, the next major support sits near the October 10 low of $1.58. That would mean roughly another 10% downside from current levels.

Momentum indicators offer a mixed signal. The Relative Strength Index (RSI) on the 4-hour chart is deeply oversold at 21.5. Historically, XRP has seen short-term relief rallies when RSI hits levels this low.

But oversold doesn’t mean the trend has reversed. It just means selling pressure has been extreme.

If XRP loses $1.86 decisively, it would signal that the broader downtrend is still intact. Until then, the market is stuck between short-term fear and long-term conviction.

And that’s usually where volatility lives.