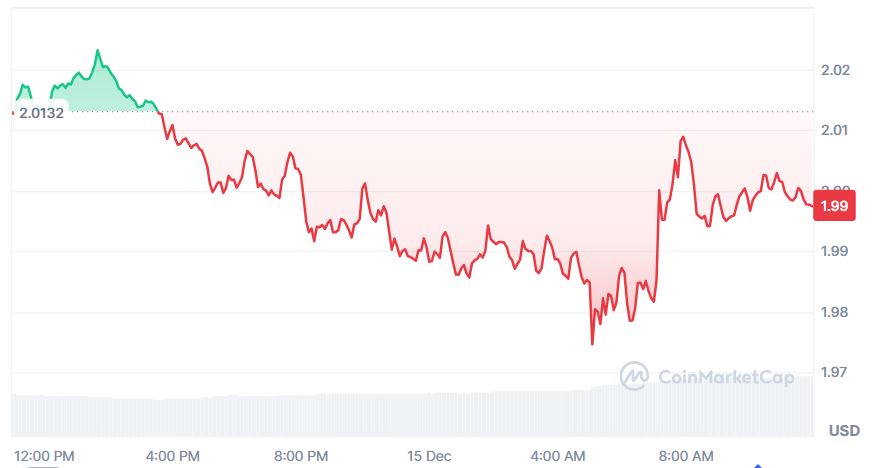

I’ve watched XRP knock on the $2.00 door so many times that it’s starting to feel personal. Knock. Rejected. Step back. Try again. Same result.

For the third time, XRP failed to stay above that key level. And this time, the message from the market was pretty loud.

XRP keeps running into heavy selling around $2.00, even as the broader crypto backdrop looks more supportive. Trading volume is high. That tells us sellers aren’t asleep. They’re actively selling into every push higher.

What makes this frustrating is that the fundamentals don’t look bad.

The Federal Reserve just delivered another 25 basis-point rate cut, bringing rates down to the 3.5%–3.75% range. That’s usually good news for risk assets. But internal disagreement inside the Fed kept optimism in check, and speculative assets didn’t get the follow-through many traders were hoping for.

At the same time, XRP’s institutional story keeps improving. U.S. spot XRP ETFs have seen steady inflows. The ecosystem keeps expanding with new custody solutions, DeFi access, and cross-chain integrations. Long term, those things matter.

Short term? Price doesn’t care. Yet.

On the chart, the problem is clear. XRP is stuck under a tight resistance band between $2.00 and $2.01. That zone has rejected price three times now. Each rejection came with rising volume, which usually signals distribution, not accumulation.

The latest attempt was especially telling. Trading volume jumped roughly 186% above average, confirming that sellers are defending this level aggressively. This kind of behavior often leads to a turning point — either buyers finally absorb the supply and break through, or price rolls over once demand runs out.

Momentum indicators aren’t helping the bulls much. RSI has stabilized but isn’t pushing into bullish territory. Intraday charts keep printing lower highs below $2.03. Until XRP can close cleanly above $2.01 with strong volume, the bias stays neutral at best, bearish at worst.

During the latest session, XRP slipped about 1%, falling from $2.03 to $2.01 after another failed breakout. Price briefly dipped to the $1.98 area before buyers stepped in, creating a short-term support zone between $1.97 and $1.98.

Late in the session, things calmed down. On the 60-minute chart, XRP bounced from $1.987 back above $2.00, helped by a volume spike of around 4.75 million units. But once again, follow-through was weak. Price slid back into consolidation.

Right now, XRP is squeezed. Buyers are defending $1.97. Sellers are standing firm at $2.00–$2.01.

Something has to give.

What traders should keep in mind

- Multiple rejections at $2.00 with rising volume suggest sellers still control the level

- A sustained break and close above $2.01 could open the door to $2.15–$2.20

- Losing $1.97 risks a slide toward $1.90–$1.92

- ETF inflows and ecosystem growth continue to build long-term support

- Until a clear breakout or breakdown appears, XRP remains a range trader’s market

XRP is standing at a crossroads. The next clean move will likely decide whether this level finally breaks — or breaks traders’ patience instead.